WIDER TRENDS, EVIDENCE AND FINDINGS

Headlines

- American Interest.

- Moving Tourism Upmarket.

- Designer Branding of Developments.

- Housing Policy achieving the Opposite of what’s desired.

- Protection of Rental Occupiers Policy going the same way.

- Finding half the answer.

- Rural (de)Population.

- Press Comments

- Sweet Spot.

- Crackdown Looms.

- Self-Build and Decennial Insurance.

- Golden Visa.

- Ban on Tourist Rentals.

- Junta to Boost Building.

- Failing to Work.

- Junta to Boost Rentals.

- Asylum Seekers.

- Gibraltar Access Treaty.

- Bathing Inland.

- American Interest –

- It is reported that in June Americans were the second most numerous tourists to Málaga city after the British. There are also reports that Americans are beginning to buy in more numbers throughout the Costas and Islands. This is driven by the strength of the dollar against the euro making Europe in general a popular place to invest.

- The ability to obtain a Golden Visa will also be attracting interest but they will need to hurry as this is being phased out throughout the EU.

- There could also be some discrepancy in the statistics as Google and other US companies have been setting up representation in Málaga and it could be that some of the business executives and their families have been visiting, with the intention of choosing homes.

- Moving Tourism Up-Market –

- There has been a drive to move tourism up-market with the hope of reducing the more extreme rowdy element. Unfortunately, there is no guarantee that money = civilised behaviour.

- Also, it could make price sensitive property buyers think twice as the cost of living becomes higher. It also results in the gentrification of traditional bars, restaurants, and chiringuitos leading to a sameness to what tourist can find in their home country.

- Designer Branding of Developments –

- We have hesitation on the long-term benefits for buyers of these properties.

- Versace is the latest to announce participation in a development in Nueva Andalucía by providing interior decor, flooring, kitchens and bathrooms.

- How much of that is heritable and therefore adding value to the property after the initial marketing hype is gone? https://surveyspain.com/2024/30/04/branded-residences-how-much-value-is-associated-with-the-brand

Social Changes and Government’s property reactions to them are starting to have a significant effect upon the property market. Not yet at higher value levels, but with there being more social displacement and even unrest due to lack of affordable accommodation, as in so many other urban areas and countries worldwide, fair solutions must be found. As a property and not political observer, it’s obvious that these policies are having the reverse effects.

- Housing Policy achieving the Opposite of what’s desired.

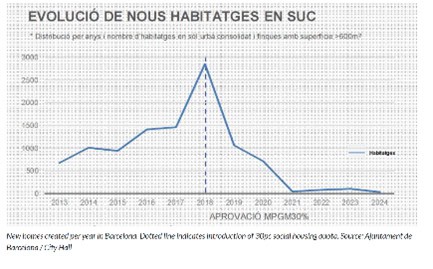

- Source for Survey Spain is thanks to Spanish Property Insight. Barcelona desperately needs low-cost homes and as the political dogma was that building developers and finance were bad, they should be the ones providing it. So, every new development in the city was obliged to build 30% of the houses as social housing.

- Why should the private developers, who had paid the price for the land assuming higher value property, be required to pay, in addition to all the costs for permission, for the social works that are the responsibility of society as a whole through local and national Government?

- Also, mixing social and private housing would not be a good social mix, benefitting nobody.

- So, developers decided to wait this one out and go elsewhere. “Barcelona needs us, but we don’t need Barcelona”.

- Over the last hundred or so years, or even longer, in many countries, similar policies have been tried all with the same result, being the reverse of the intentions.

- Protection of Rental Occupiers Policy going the same way.

- In April 2024, when declaring their intention to remove the ‘Golden Visa’, somewhat illogically the Spanish Government linked that to the shortage of worker accommodation.

- They declared they will bring forward further legislation to ensure there is accommodation available in cities at long-term rents affordable by service and other workers. That’s added to the new national Rent Act that came into force throughout Spain on 18th May 2023.

- Effectively, it gives tenants greater rights to stay and owners less rights to recover their property or increase rents, no matter what the agreed lease states and even if the tenants are not paying rents or expenses, and the lease is not ended by transfer of ownership. It also appears to give squatters greater rights.

- What has been the result? As predicted, a significant drop in long-term rentals, significantly higher rents, and mass transfer of accommodation to short-term rental, coinciding with the ease of finding tourism tenants through Airbnb, Booking.com, etc at even higher rents than before.

- ‘Buy-to-Let’ short-term has become a popular investment, raising the prices of inner-city apartments and gentrification, leading to an even greater shortage of long-term rentals at a social level, which is the opposite of what the policy was supposed to do.

- Finding half the answer.

- Valencia Region, which other authorities are sure to follow, has announced significant restrictions on short-term letting, prohibiting new being created unless the property is completely separate from the rest of the building it’s in, and strengthening the right of local communities to prevent use of apartments for short-term rentals.

- Where licences have already been granted, these now must be renewed very few years, which effectively means the authorities can remove them. This applies to short-term rentals only, with encouragement being given to changing the use to long-term.

- That’s only half the answer – stopping the transfer of long-term to tourist rentals.

- However, the other half is the imbalance of rights of tenants and owners, which is so heavily biased towards the occupier, no matter how bad a tenant they are, both in lease compliance and often socially to their neighbours.

- That requires the National Government to change the Rent Act, something politically they will find very difficult to do.

- When mortgage rates are added, plus inflation in the general costs of living, the hopefully short-term prospects for owners, investors and tenants are very uncertain.

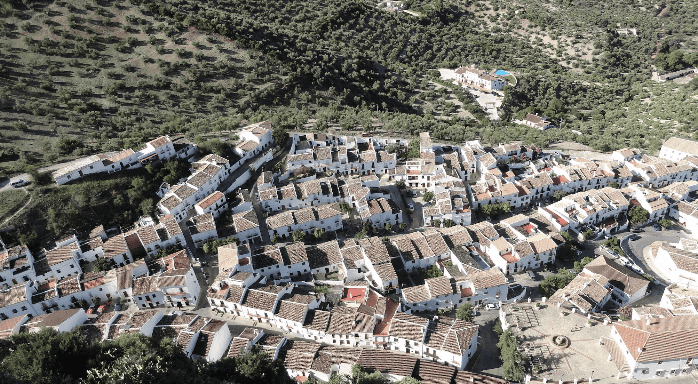

- Rural Depopulation –

- Answers to this can be found and could have significant beneficial effects upon the troubles mentioned above.

- Depopulation has been a problem in many countries for many decades and even centuries.

- The younger, brighter people move away to school and university and, as the old WWI song goes, “How Ya Gonna Keep ’em Down on the Farm After They’ve Seen Paree?”

- The region of Extremadura is now offering incoming digital nomads 10,000€ euro to live in some of the towns with reducing population.

- However, it may not be necessary in the future as it’s possible now to live a modern life with the essentials of fast internet being available throughout Spain, and less need to commute to an office. This could be the salvation for rural depopulation.

- As young people mature and realise the expenses of living in the large cities, plus the security and environmental problems of bringing up a family there, they could be looking at the cost, environmental and social benefits of living in the countryside.

- This will also apply to professionals such as doctors and teachers tired of the pressures of the ‘rat race’ of the city who will know they can come to the countryside and be appreciated.

- Perhaps we may see the population of the cities catering for youth and tourists, whilst the families retire to the country.

- https://surveyspain.com/2023/30/10/what-do-you-value

- Press Comments

Recently, we’ve started providing a comment on articles in the principle English language newspapers and magazines. Below is a copy of the latest which may be of interest.

a) ‘Sweet Spot’ – a report by Spanish Property Insight – indicating that the Spanish housing market is showing gently rising sales and prices, giving confidence to all.

-

- Research by Survey Spain indicates that in the last few months there has been somewhat of a lull in the number of properties sold and, strangely, in prices. Could they have already risen too high? We are receiving emails from agents mentioning reductions in price and higher shared commission, both of which show a certain urgency with regard to selling. On the other side, agents are struggling to find sufficient properties for the level of demand, and we are told that most new builds are pre-sold off plan, which should be increasing prices.

- It must be remembered that the Costas, and especially western Costa de Sol, are a very different market from Spain in general.

- A Spanish agent has mentioned 3 determining factors which are appropriate for the ‘normal’ Spanish market, (interest rates, the willingness of banks to provide credit, and the labour market): however, the Costas and Islands are a different ‘country’ and economy. The strength of foreign home markets is a vital factor, exchange rates, ease of travel, somewhere safer to put money rather than having it in Eastern Europe, or Middle East, or in UK with potential wealth tax, or USA with either Trump or the Democrats, or many other places with problems, make Spain look a safe place – as long as Madrid doesn’t do something irrational but according to political dogma to change it all

b) Crackdown Looms – this is the dogma I was hinting at in ‘Sweet Spot’ above. (and see Valencia proposals above)

- The government is intending to introduce new rules to crack down on short-term property rentals, in the hope that will leave more for long-term occupation and reduce the demand. Short term lets give higher income with greater overhead costs, but without those, the rules could result in more vacant properties, as the problem is as much the inability to remove bad tenants, leaving the property owner with all the costs but no income.

- The property owner shouldn’t be responsible for the social costs of housing people who have become accustomed to excluding rent from their personal economy.

- https://surveyspain.com/2024/08/07/we-all-should-have-housing-for-free

- This idea is further expanded in a long article entitled AirBn-Broken by Terra Meridiana.

c) Self-Build and Decennial Insurance – Experienced and Trustworthy

- Just remember not to skimp on costs by not taking out the decennial structural insurance.

- That will reduce the value of the house because the foundations and structure hasn’t been independently assessed by representatives of the insurance company as it was built.

- It will mean that you’ll are legally prevented from selling the property within the first 10 years unless the buyer agrees to accepting the lack of insurance. They’re only going to do that if they receive a discount on the price.

- Also, there could be considerable difficulty in obtaining a mortgage.

d) Golden Visa – From the EU

- The Spanish government is removing the possibility of a non-EU person buying residency through a property investment of 500,000€ euro

- Somehow, the Spanish government has logiced their way to linking this to the lack of long-term rentals, though there are few properties bought at that price that can be rented at a level low enough for a services worker to afford.

e) Ban on Tourist Rentals by Urbanisation residents –

-

- According to the writer of the Article, this could reduce the value of properties within the urbanisation by up to 15%.

- Living in an urbanisation of apartments where we voted not to have any more tourist rentals, they can make such extremely bad neighbours that I would pay more to move into an urbanisation where there are none.

- Tourists are on holiday, and they want to party, party, party, with the hours of that not mixing at all with those of regular worker residents. The tourists may have no respect for the equipment of the urbanisation or other residents, and little language or cultural understanding.

- Yes, for once I agree with what the national Government is trying to do.

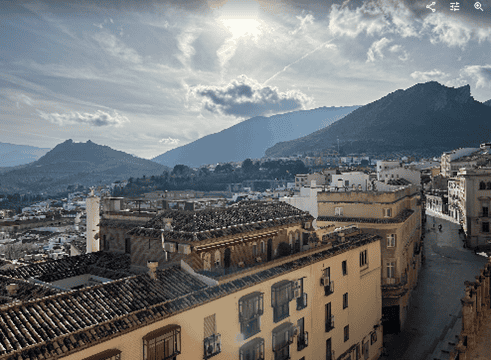

f) Failing to Work – back to the lack of housing for service workers and tourism swamping traditional city living in picturesque cities.

- Lots of statistics from analysis by Idealista on the reduction of long-term accommodation, the increase in rentals, and the ineffectiveness or even harmful effects of past actions by the authorities.

- It’s what has been said would happen from the start, as historical evidence in many cities and countries have shown. But no, the political dogma must triumph and once again is being shown to fail.

- “If you always do what you’ve always done — you will always get what you’ve always got.” Albert Einstein.

g) Junta to Boost Building – to provide 20,000+ affordable rental properties

- A positive action but as they’re stating it will take five years, where are people to live in the meantime?

- It’s only by releasing the existing properties to be available for a long-term that there can be any quick solution. And that will only happen by a combination of abandoning the restrictions on removing bad tenants or compensating the owners if they are to remain in place; and restricting the number of short-term rentals.

- With regard to the latter, that is likely to raise the rent being charged to tourists and fewer rentals being available, which may have the effect of reducing the number of tourists in a city. That limitation of numbers must happen in the same way as there are limitations of numbers seeing special places such as the Alhambra in Granada. It’s impractical to build a wall around the city to keep the tourists out, so the only way is to restrict the places where they can live and charge for vehicles entering. It’s not going to be popular, but then neither are social riots by those wishing to be permanent residents.

- The concern must also be where the 20,000+ are going to be built and how are they going to be restricted to be affordable.

h) Asylum Seekers – another intractable problem

h) Asylum Seekers – another intractable problem

- The story of one woman and her journey to Spain will be duplicated thousands of times over.

- The lack of respect at all times must be soul-destroying and yet they keep going because there is no alternative.

- So, when you see an immigrant, be respectful because their journey is much more likely to have been many times harder than your own.

- Remember that an Expat is also an Immigrant

i) Gibraltar access treaty – Unlikely before November

- And why is November an important date? That’s when the new Schengen border controls are due to come into place, which will further restrict and delay access in both directions.

- It’s important not just to Gibraltar, but to the economy of the whole of the Gibraltar/Algeciras Bay area. Hopefully, London and Madrid (and the Spanish football team) will realise that the status quo has no benefit to anyone.

- Property in the towns around the Bay is currently relatively inexpensive and it will be interesting to see what happens when a border agreement is achieved.

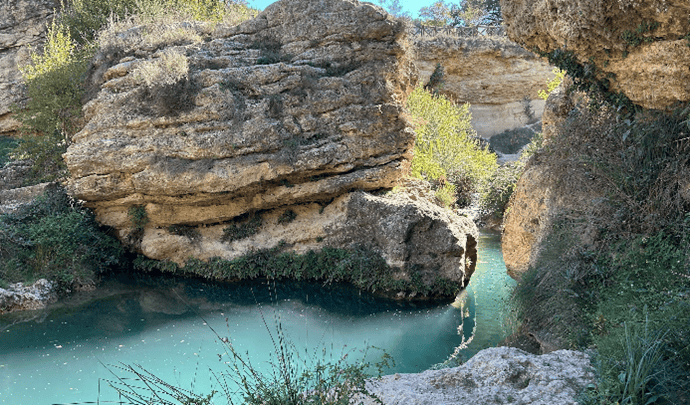

j) Bathing Inland – The joy of freshwater pools and the rivers where there is still water running.

- Having enjoyed those myself over many years, the lack of sand between one’s toes is a further benefit.

- However, I wish that newspapers wouldn’t publish articles about them, and the same about the beautiful beaches, or they, in the same manner as the cities, will become overcrowded, commercialised, and lose their charm.

STATISTICS

We continue to keep a record of the average difference between Asking Price and Actual Selling price, where we have been supplied with that information from reliable sources. These are often from clients for whom we have carried out a building survey/home inspection, and they inform us what price they are actually paying for the property after receiving our report. We can use that information to improve the accuracy of our current market valuations.

Average Difference Between Asking Price and Actual Selling Price.

1st Quarter of 2023

January to March – 12.03% More than double last year and standing out as very different from any recent quarters. The amount of evidence was small and was influenced by one property where the discount was 30.41% for an older, renovated property that had been on the market for some time, and the owners were at last persuaded that they weren’t going to get back the total cost of their improvements.

2nd Quarter of 2023

April to June – 7.86%. Back to a more realistic level reflecting the reality of the market, with the smallest being 5.41% and largest just short of 10%.

3rd and 4th Quarters of 2023

July to December – 7.33%. Due to a shortage of information, we’ve combined those two periods, with the resulting figure supporting our impression of a steady market and the seller still having a stronger ‘hand’ due to the shortage of supply.

1st Half of 2024

January to June – 5.69% A significant fall since the last half year, most probably caused by the shortage of property lessening the negotiating strength of the buyers. It must be remembered that this is an average of all the Regions of Spain in which we are active and varies from -12% to only -1.32%.

Some contacts have reported competitive bidding on popular houses above the asking price. That is a practical action in Spain, with the ‘winner’ being obliged to immediately submit the 10% deposit, knowing that they will lose it if they pull out. Equally, the seller, who may be approached with a higher offer after the bidding, will know that they must repay the winner’s deposit, plus a ‘penalty’ of the same again, before being able to accept any higher offer.

Changes in Multi-Listing Site – Resales Online

Comparison of figures are restricted to one region, and we have chosen Costa del Sol, as being the most active on the website. January figures in brackets.

We found on 3rd August 2024 that there were –

- 11,543 (13,835) properties for sale at 100,000€ euro or more, a very significant -16.6% (+0.2%) drop on our last recorded analysis in January 2024, confirming the reports of there being fewer properties available.

- 3,546 (3,973), 30.7% (28.7%) were priced at 1,000,000€ euro or more, again less than there were 7 months ago.

- 192 (153), 5.4% of the total of 100,000€ euro, a significantly increase, were identified as representing new developments.

- 94 (77) 49% (50.3%) of the total of new developments were priced at more than 1M€ euro. A similar %, but a higher number.

- 1,260 (1,599) 10.9% (11.6%) of the 100,000+€ euro properties are found to have a discount of -10% or more since first listing, which is slightly less in % terms than the previous analysis, but significantly lower in numbers.

- Those increasing their price by +10% or more was 868 (1,095) 7.5% (7.9%), which is slightly lower than the previous period.

- 446 (505) 12.6% (12.7%) of the 1M+€ euro properties were found to have reduced their prices by 10% or more, being almost the same in % terms than previously.

- 390 (493) 11% (12.4%) of the 1M+€ euro properties to have increased their price by +10% or more, being less in number and % than the last period.

- 1,124 (1,476) were found to be available for long-term rental, a substantial decrease.

- 141 (304) 12.5% (20.6%) being available at 1,200€ euro per month or less, a substantial reduction.

- 609 (654) 54% (44.3%) were available at 2,500+€ euro/month, a significant increase.

- 261 (271) 23% (18.4%) at 5,000+€ euro/month, a similar number but a significant % increase since January.

- 1,388 properties are available for short-term rental, still a substantial number at the peak of the holiday season.

- Only 160, 11.5% of these properties are shown to have a short-term licence number.

Analysis

- The numbers and % changes confirm that the market is experiencing a reduction in supply of properties for sale; however, the number of new developments is increasing, which will alleviate that shortage a little. However, as most new developments are understood to be largely pre-sold off-plan, they will not increase the numbers of properties available unless buyers want to immediately resell if there is a capital profit. Most developers now prevent transfer of presale contracts as that created a market competing with their own. If buyers want/need to pull out of the purchase, the developer will take it back but retain all monies paid as a ‘penalty’.

- Again, the rental figures confirm what is suspected, in that the number available for long-term rental has dropped and the rents being charged have increased.

- We did not record the short-term rental in the past, so do not know the direction of the numbers, but the big surprise is how many of them do not appear to be registered. The sellers and agents, including Resales-Online are taking substantial risks in marketing these properties openly.