AGENTS’ AND PROFESSIONALS’ OPINIONS

We’ve selected a spread of professionals for opinion, and not solely Estate Agents.

The market appears to be continuing strongly, but with no extraordinary dip or rise in demand or supply on the horizon. However, as all over the Costas, local to Survey Spain’s office there are 5 significant apartment urbanisations being developed, phases of which are likely to come to completion at the same time this year. Only then will we know the success of their off-plan marketing, and how many purchasers are wanting to hold and occupy either themselves or for rental or have acquired as an investment for selling on.

Finance Broker – whole expat market in Spain

Demand undoubtedly slowed towards the back end of last year, principally because of the increase in interest rates. It appears that demand for property dropped too. However, with the rates reducing last month there was an immediate increase of enquiries. It has continued into this year. The office cannot believe the volume, which isn’t normal for January. The enquiries are from a mix of sources with UK being a solid base of approximately 40%, but they have inquiries from United States, Switzerland, France, etc. Many have bought off-plan up to two years ago and are now seeking the best deal for their final significant payment, although many end up taking the mortgage being offered by the developer.

Lawyer – Costa del Sol and Costa Blanca

2023 was the best year that they’ve had and this year has started off with a bang. There’s been interest from the US and also the return of Irish clients. Prices are still going up, but they have stabilised to a certain extent. Many are buying off-plan. There is mention of Israeli buyers and developers/investors getting out of their local market. He can’t see any negatives for this year with theirs being principally the English-speaking market of UK, US, Canadians, Irish, etc.

Estate Agent – Sotogrande

They’ve had two good years. The change in interest rates, up or down, hasn’t had a notable effect. Buyers tend to be using their own money and therefore the mortgages are not so significant. People are interested in the area because of the low density of development and it being a good investment and ‘safe haven in the sun’. The International School is a major factor and it’s extending its educational range all the time. Sotogrande is becoming better known internationally possibly by attaching itself more to marketing with Marbella. The inventory is becoming less, so it’s probable that prices will increase. The Gibraltar connection is also significant especially with regard to the personnel in gaming companies.

Estate Agent – Marbella

2023 was a good year with a significant volume of sales. From December and this month so far the demand has been very good. It has slowed at the higher level of €3+ million principally due to poor stock availability. The interest rate increases also had some effect, but with these being decreased it’s expected that the market will continue as it did before. They’ve had inquiries from all over including the United States, China, UK, and Ireland. The higher end properties tend to be bought by Dutch, Belgian, and Scandinavian clients. The demand from Eastern Europe has reduced slightly, but they have now had inquiries from Israel.

Magazine Owner and Editor – Marbella

99% of my clients are coming from Europe, but this year I have seen an increase of buyers from the USA.

In my case I have only had one, and that was for the purchase of rustic land for organic farming.

The rest, as always, are from Northern Europe and England (no Scottish or Welsh).

In this area, as there has been a Belgian colony for many years, the number of people coming from there is higher.

The profile of buyers has not changed, older people, over 50/60 years old, retired, looking to enjoy an excellent climate, a cheaper standard of living than in their countries of origin.

As for the type of property, in the vast majority, I would say that in more than 90% of cases are detached homes, very few apartments (at least I have worked on this year).

In terms of location, the dwellings are in rural areas and small towns or clusters of few dwellings (Diseminados). I understand that the Covid issue, with mobility restrictions among other things, must have had an influence.

Regarding the prices that are asked and finally sold, in my case, I have had from €50,000 (homes generally in fair condition) to €500,000. The range is very wide and the difference between the prices mentioned does not vary more than 5%/10%. Sellers usually stand firm, I guess because they know there is a market.

I have had some cases of bank repositions where it is not possible to counter-offer.

As for new developments, both in collective and individual housing in this region, there has not been a large increase. There is a lot of empty housing stock, which is not being rented either.

Architect – Almería

Architect – Almería

99% of my clients are coming from Europe, but this year I have seen an increase of buyers from the USA.

In my case I have only had one, and that was for the purchase of rustic land for organic farming.

The rest, as always, are from Northern Europe and England (no Scottish or Welsh).

In this area, as there has been a Belgian colony for many years, the number of people coming from there is higher.

The profile of buyers has not changed, older people, over 50/60 years old, retired, looking to enjoy an excellent climate, a cheaper standard of living than in their countries of origin.

As for the type of property, in the vast majority, I would say that in more than 90% of cases are detached homes, very few apartments (at least I have worked on this year).

In terms of location, the dwellings are in rural areas and small towns or clusters of few dwellings (Diseminados). I understand that the Covid issue, with mobility restrictions among other things, must have had an influence.

Regarding the prices that are asked and finally sold, in my case, I have had from €50,000 (homes generally in fair condition) to €500,000. The range is very wide and the difference between the prices mentioned does not vary more than 5%/10%. Sellers usually stand firm, I guess because they know there is a market.

I have had some cases of bank repositions where it is not possible to counter-offer.

As for new developments, both in collective and individual housing in this region, there has not been a large increase. There is a lot of empty housing stock, which is not being rented either.

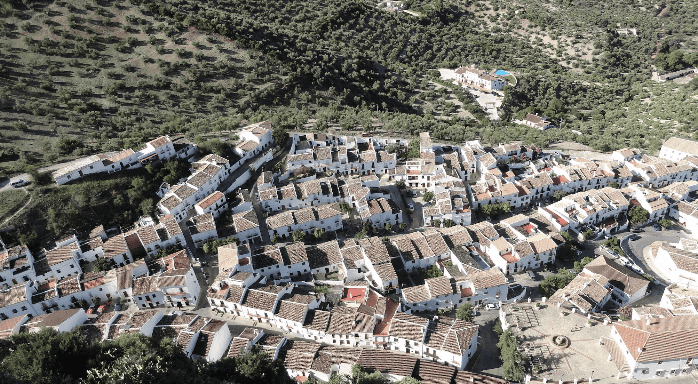

Valuer – Almería

I can only talk about the area where I live, which is Mojacar (Almeria). It seems to be having somewhat of a renaissance with a new retirement home, a new bus station and a new medical centre due to open next summer. The AVE from Almería to Murcia and then onwards is well under construction, with a station at nearby Vera. Added to which, the takeover of Macenas Golf by the internationally known and again local marble group Cosentino and their plans to spend 200 million and make it a world class resort with a five-star hotel will certainly bring in more top-class buyers. Added to the fact that there are more high-end restaurants opening, Mojacar being one of the prettiest villages in Spain and having won the Ferrera Roche prize last Christmas, Mojacar certainly has a bright future! PS. I am not secretly working for the local tourist board! Foreigners are now buying 48% of the properties in Almeria, the highest in Andalucia. Málaga comes second at 42%.

Architect – Costa Blanca South

Having suffered in the last months of 2023 the increase of the interest rates and skyrocketed inflation, everybody expected prices of dwelling to be sunk by the end of the year. However, figures are keeping a good health and it is not expected, according to experts, that houses lose value during 2024. This is due to the increase of demand and the deceleration of the offer. Spain has gained population during 2023 and it has surpassed the figure of 48 million. Most of them adults as the increase is represented by foreigners. In fact, the area of the whole country with more relative growth is Alicante province and the town that leads in Alicante is Torrevieja, the core city of the southern Costa Blanca. Data shows that the demand for residential accommodation is 5 times higher than the offer of it. This fact keeps the balance of prices as otherwise they should be dropping because of inflation and the increase of interest rates.

Architect and Valuer – Valencia

The Valencian Community is about to finish the year 2023 with more houses being sold compared with Cataluña or Madrid. 52% of those operations are concentrated in the province Alicante and 45% of the buyers are foreigners. Alicante has consolidated as a permanent residence province, such as many other Mediterranean coastal areas in Spain. The demand is diversified based on first, second residencies, change of the current residence, remote workers, digital nomads and retired citizens. The traditional buyer´s nationalities are still led by British, Germans and French, but more and more Russians, Ukrainians, Polish and remarkably rising the Netherlands.

The market has been very active, keeping a constant level of demand and periods of lack of offer. Buying as investment is focused on the interior of the cities, where foreign workers, mostly from Eastern Europe and North Africa achieving a stable economic situation, are buying to rent. In cities such as Valencia, the investment is focused on the conversion of empty commercial properties at the ground level of block houses into residential units, to destine them to tourist or long-term rental. Asking and final sale prices do not in general have a big difference, due to the high demand. The resale prices are always tied to the level of renovation, refurbishment or investment done in the property, in order to make it more attractive.

Multi-Lister – Marbella and Balearics

Ibiza has had a surge in prices, like everywhere during and post Covid and as demand has outstripped supply that trend has continued. Importantly it’s worth noting that much of the new supply has been at the high end with many new apartment developments coming in over €10k per square metre. This has led to sellers of resale properties following suit – take a look on Idealista what €500k gets you in Ibiza Town or Santa Eulalia these days. Mallorca has been the cheaper option for a very long time but has been catching up quickly since 2021. Even a good number of long-term Ibiza residents have moved there, and it’s now pretty difficult to buy what looks like a real bargain there too. All this really pushes up the average per metre price much to the dismay of the ‘ordinary’ person. Except those with legacy family property of course.

Contributors

Contributors

Thank you to the business leaders, for giving your time and thoughts – in alphabetical order –

Daniel Gonzalez – Almería

Fluent Finance – Spain

Invenio Homes – Marbella

My Lawyer in Spain – Costa del Sol and Costa Blanca

Noll Properties – Sotogrande

Panorama – Marbella

PPMQuilES – Arquitecto – Costa Blanca South

Rimolo & Grosso Architects – Costa Blanca North and Balearics

Survey Spain Network Valuer – Almería

Take care and we’ll all get through this.

We’ve just got to work out what sort of world it will be,

and what part we will play in it.

Campbell D Ferguson

FRICS, Land Economist.

Chartered Surveyor in Spain. Director. Survey Spain SL.